At the beginning of this year, the picture was crystal clear: any stock carrying the words "artificial intelligence" or "AI" in its description was climbing with ease. Investing in mega-cap technology was like placing the only bet you couldn't lose. But in December 2025, the scene has changed completely.

What Changed the Game?

Well, no single dramatic event occurred. Rather, a collection of things began unfolding slowly, raising serious doubts among investors:

- Insane Capital Costs: AI companies (especially in GPU and server segments) require massive investments. We're talking about billions annually. And profitability? Still nowhere on the horizon in many cases.

- Competition Intensifies Rapidly: There's no longer a "secured advantage" for any single AI company. Everyone's developing similar models. ChatGPT isn't alone anymore. Google, Microsoft, Amazon, and even Meta are in the race.

- Valuations Have Become Unrealistic: Some tech stocks were trading at historical multiples with no rational justification. Smart investors started taking their profits.

- Federal Reserve Decision: Expectations of interest rate cuts benefited small-cap stocks and companies struggling with high debt levels.

— Analysis from Madison Investments

Where Is the Money Going Now?

Investors are currently focusing on three main sectors:

What About Cryptocurrencies?

While the stock market undergoes rebalancing, the cryptocurrency market is moving in a completely different direction. Bitcoin approached $123,500, and Ethereum surged over 30% recently. This signals that investors maintain confidence in digital assets despite stock market uncertainty.

The difference is that cryptocurrencies now attract investors anticipating positive Federal Reserve decisions. Lower interest rates + potential inflation = increased demand for Bitcoin.

What Should You Do Now?

If you're tracking the market now (or considering entering it), here's what experts are saying:

- Diversify Your Portfolio: Don't put all your money into one technology or sector. Risk distribution is wisdom.

- Search for Value, Not Just Growth: Companies paying dividend distributions with stable earnings may be the best choice in the coming period.

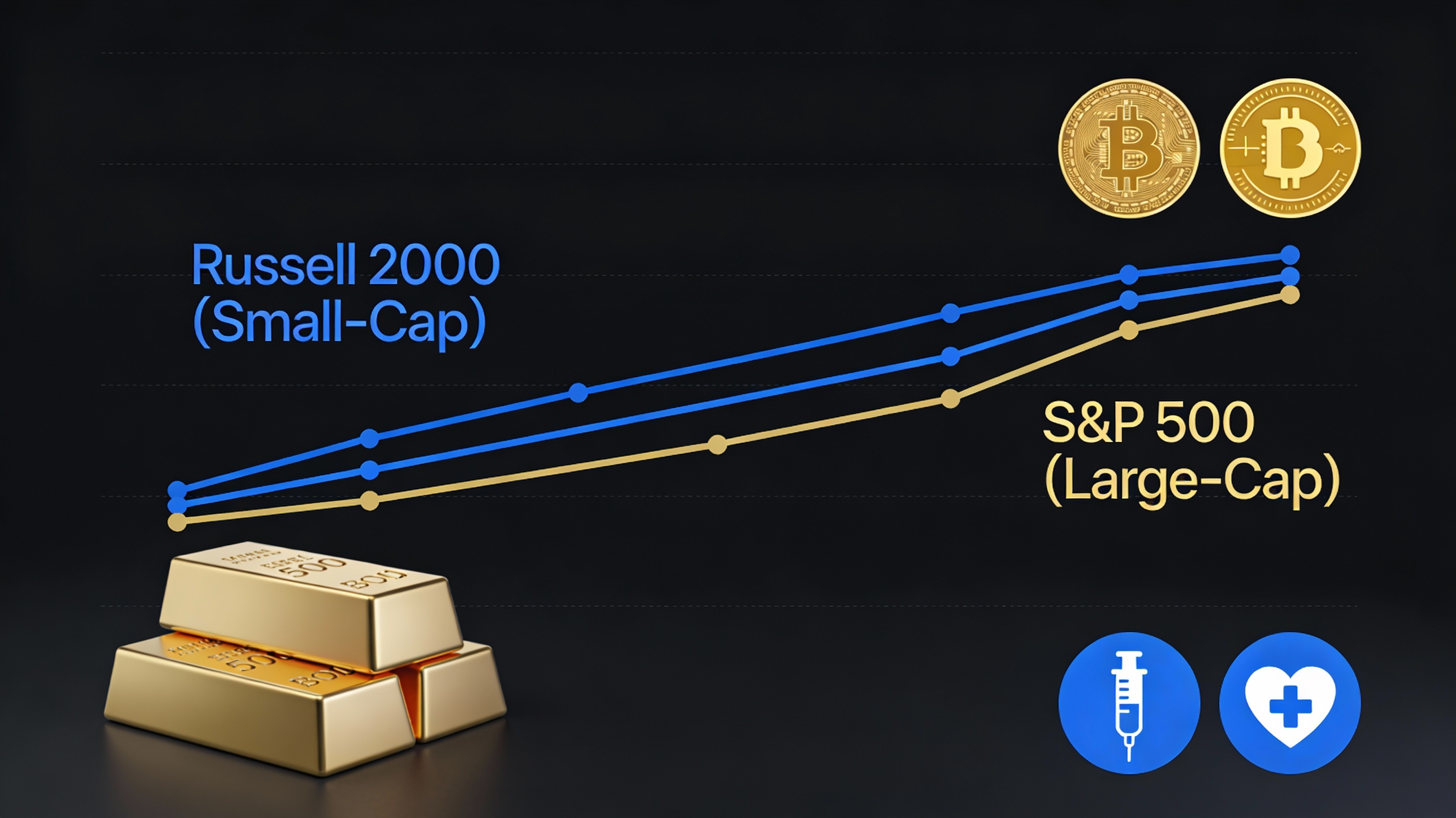

- Monitor Small-Cap Stocks: Russell 2000 still has vast room for growth. Not every small stock is famous, but some might be hidden gems.

- Don't Ignore Gold and Commodities: In uncertain times, traditional assets like gold provide protection.

- Watch Sterling and Canadian Dollar: Currencies also respond to central bank decisions.

The Deeper Story: Is This the End of Tech's Golden Age?

No. But it's the end of the "madness" era, where any tech stock climbed simply because it existed. Now things are more realistic. Companies with:

- Clear and profitable business models

- Strong cash flows

- Genuine competitive advantages

- Clear plans for profiting from artificial intelligence

These companies will continue rising. Others will face significant headwinds.

Final Conclusion

2025 hasn't been a bad year for stocks. The S&P 500 is up 17% since the start of the year. But the way this gain happened has changed. It's no longer driven by a small group of mega-cap tech stocks. Instead, the market is broadening. That's a healthy sign of a more balanced market.

If you're looking for opportunities now, the field is wide open. Small-cap stocks, healthcare, energy, even cryptocurrencies... each has a story to tell. The smart investor is the one who reads these stories carefully.

---

Did you enjoy this analysis? Follow ApexTicker for more daily updates on stock markets and cryptocurrencies.

Back to Home Page